Stockholm (NordSIP) – For the past couple of years, Eurosif, the pan-European association promoting Sustainable Finance at the European level, has put considerable effort into examining the challenges and possible solutions regarding the accuracy, efficacy, and comparability of climate-related reporting. A specially assembled Climate Reporting & Indicators (CRI) Advisory Group consisting of practitioners with a keen interest in ESG data has been discussing the matter in depth, searching for an answer to one overarching question: Which climate indicators are truly decision-useful for investors?

The output from their work, coordinated by Eurosif’s policy group, is a newly published report on the use of climate-related data in investment processes. Informed by the GRI group’s discussions, the report summarises the results of a quantitative survey and additional qualitative interviews among European asset managers and owners on their current use of and requirements regarding climate-related information and the way they integrate it into their investment processes.

They all do it, but how?

On a positive note, Eurosif’s report points out that “the use of climate-related information in investment processes is now a matter of course.” That said, the ambition level of asset managers and asset owners in this respect seems to vary considerably.

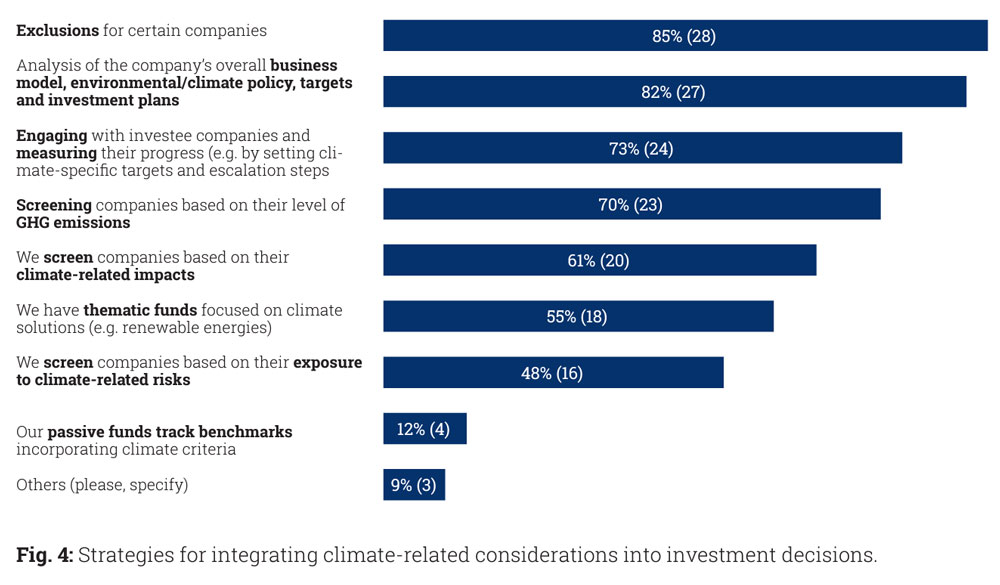

“Next to exclusion strategies, among the most used approaches for integrating climate-related information in investment processes are screenings and assessments based on GHG emissions and general information about investees’ climate strategy,” state the authors. “Less prominent are forward-looking metrics such as climate targets and transition plans.”

Sourcing the data, and plugging it in

The study also attempts to identify the main sources of climate-related data and information that asset managers and owners tend to use, recognising that these constitute the basis for any analysis and investment approach. Not surprisingly, investment practitioners testify that they rely on corporate reports and data sourced from external service providers. Even though one hundred per cent of those participating in the survey receive climate-related data and information from at least one service provider, and an overwhelming majority indicate that they use multiple ones, most still consider “raw data” directly reported by the companies they invest in indispensable.

“Only a small proportion of respondents, usually from smaller firms with fewer resources, stated to regularly rely on external data sets and analytical tools without any further internal processing,” states the report. “At the other end of the spectrum, more sophisticated investment strategies involve the analysis and combination of different external data sets and their integration with further, internal research.”

As to challenges, most surveyed organisations quote data coverage and the costs of gathering the information. Asset managers and owners struggle in particular with finding reliable forward-looking indicators that would enable them to manage climate-related risks and opportunities in their portfolios.

The wish list

Eurosif’s report does not just describe the current state of climate-related data and information. The authors also formulate a number of policy recommendations targeted primarily at EU policymakers and standard setters.

At the top of the list is a standardised disclosure framework for climate and sustainability-related information that would foster comparability and quality of corporate disclosures. According to the authors, ongoing regulatory initiatives, such as the development of climate-related European Sustainability Reporting Standards (ESRS), are a good starting point. Transparency requirements for external data providers should be part of the solution, too. The industry should also develop science-based climate-related base indicators focusing on forward-looking metrics.

A strong recommendation is to raise the overall ambition level, striving for disclosure standards based on a double materiality approach that cover climate targets, transition pathways and decarbonisation plans as well as the corporate value chain.