Healthcare is expensive and stubbornly inflationary, particularly in the US. Despite spending the most per capita on healthcare, the US underperforms all other developed nations in terms of life expectancy.

Whilst care for the well insured is world leading, it is also very expensive. But, an estimated 27 million (Source: US census bureau) US citizens are ‘uncovered’ and thus have very limited access to healthcare, leading to poorer population health and a higher burden on the most expensive, emergency care. Emergency medicine is necessarily reactive and inefficient, whilst having almost no preventative impact.

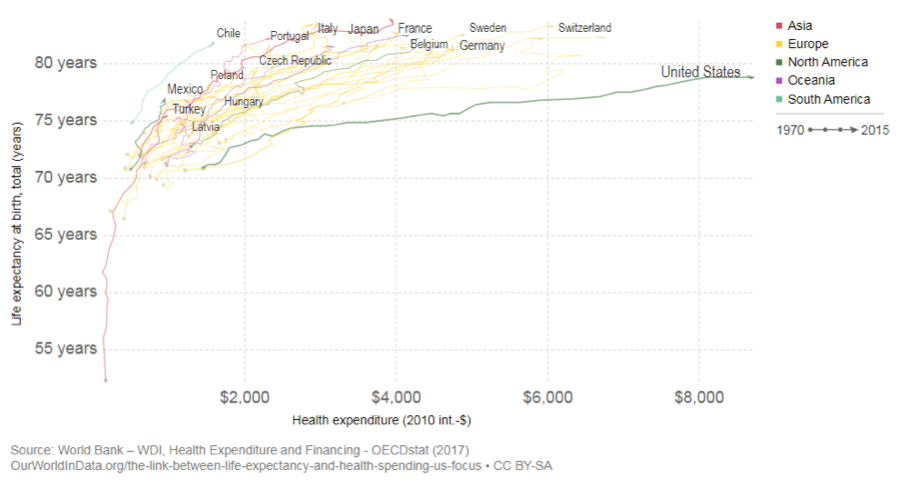

Life expectancy vs. health expenditure, 1970 to 2015

Health financing is reported as the annual per capita health expenditure and is adjusted for inflation and price level differences between countries (measured in 2010 international dollars).

What is the value of a human life? Apparently 90% of healthcare costs come in the first and last six months of a human life (unverified claim). Does this mean that a ‘survival of the fittest’ attitude would be cheaper? Not necessarily. The net contribution to society of these groups is very difficult to measure.

National healthcare systems such as that in the UK have independent bodies like NICE that undertake the daunting task of human life cost-benefit analysis. NICE use the buying power of the NHS to negotiate prices down and prevent treatments being covered if they are deemed too expensive.

Meanwhile in the US, the ‘Obamacare’ act sought to gain healthcare coverage for an additional 23 million people (the US census bureau estimated 48 million or 15.4% of under 65s were uninsured pre-Obamacare). This has increased healthcare costs in the short term and ‘value-based care’ has been a focus since. A shift from a simple price negotiated with the healthcare supplier towards an evidence-based demonstration of value. In plain English, healthcare suppliers need evidence that treatments are worth the cost.

The long-term implication for investors is clear. Healthcare products and services that offer demonstrable value will gain share and be able to maintain prices versus the questionable and overpriced. Evidence is becoming more valuable. Capturing data, knowing how to analyse it and then using it to improve outcomes is ever more critical. The good companies we speak to realise this and want to be on the right side of this shift.

The answer to the challenge of reducing costs in the healthcare system lies in the power of technology. Whether it is an innovative medical device, a new drug or redesigned hospital protocol, technological and business model innovation, and its deflationary impact, is probably the most likely and sustainable solution.

We believe that each of the companies below is leveraging technology in a meaningful way to improve health outcomes and reduce cost, whilst capturing value for shareholders in the process. We see it as our job as sustainable investors to seek out these win-win outcomes:

[table id=4 /]Picture © Kames Capital