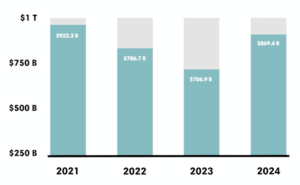

Stockholm (NordSIP) – After three years of decline, the 2025 edition of the Banking on Climate Chaos (BOCC) report shows that fossil fuel financing by major global banks has increased by $162.5 billion from 2023 to 2024. Financial institutions that initially joined the climate action bandwagon in the wake of commitments made at Glasgow’s COP26 in 2021 have since combined to provide a cumulative $1.6 trillion to fossil fuel companies.

While the banking sector has already attracted regular criticism for its continued financing of fossil fuel investments against the guidelines of the International Energy Agency’s (IEA) Net Zero 2050 scenario, this sudden uptick in funding after several years of decline is cause for alarm.

Fossil fuel financing from the world’s 65 biggest banks – Lending and underwriting to the fossil fuel sector

Source www.bankingonclimatechaos.org

The BOCC report is based on the lending and underwriting activities of 65 large global banks, including bond issuances, loans, and share issuances. The research is conducted by BOCC coalition which includes Rainforest Action Network, BankTrack, the Center for Energy, Ecology, and Development, the Indigenous Environmental Network, Oil Change International, Reclaim Finance, Sierra Club, and Urgewald. It has been endorsed by 480 organisations in 69 countries. The underlying analysis focuses on banks’ financing of companies listed on the Global Oil and Gas Exit List (GOGEL) and Global Coal Exit List (GCEL), which are those firms that are actively expanding their fossil fuel production and neglecting the low-carbon transition.

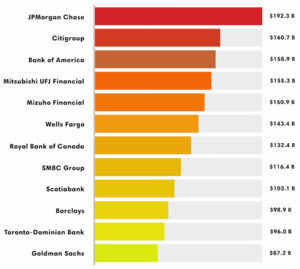

The overall ranking is top-heavy, with 12 banks labelled the ‘Dirty Dozen’ responsible for a disproportionate share of the overall financed emissions of the 65-strong peer group.

The Biggest Fossil Fuel Financiers Since 2021 – Top 12 banks financing fossil fuels globally, 2021-2024

Source www.bankingonclimatechaos.org

Loans were the top form of financing during 2024, with an increase to $467 billion from $422 billion from 2023, while bonds saw the largest increase to $401 billion from $284 billion in 2023. Acquisition finance also grew by almost $20 billion to total $82.9 billion in 2024. The upper echelons of the Dirty Dozen consist of US and Japanese banks. JP Morgan retains its position as the world’s largest financier of fossil fuel expansion in the world with $53.5 billion spent supporting the sector last year.

European and Nordic showing

Barclays Banks stand out as the only European bank in the leading group, as well having been one of four otherwise US banks with the largest absolute increase in funding during 2024. This was despite the UK bank having published a new Climate Change Statement last year which was presented as a positive climate action step, which NordSIP pointed out was replete with loopholes. Other major European fossil fuel financiers include Spain’s Santander, France’s BNP Paribas, and Germany’s Deutsche Bank. The only Nordic banks represented in the Top 65 are Nordea and Danske Bank in positions 57 and 61 respectively. Nordea’s fossil fuel financing totalled just under $6 billion and Danske Bank’s $4.8 billion.

Commenting on the 2025 BOCC update Diogo Silva, report co-author and Campaign Lead Banks and Climate a, BankTrack said: “I dream of a time when we don’t have to produce this report anymore, as we would finally be protecting present and future generations from catastrophic living conditions. Instead, at the same time that fossil pollution is spreading death, months of rain are pouring down in hours, and other once extreme weather events become ever more ‘normal’, banks are banking even more on climate chaos! Millions of lives are at stake and the data is clear on which direction banks are bringing us. It’s about time to make fossil banking history.”

The organisations behind the BOCC report and database would like these banks’ customers to draw on the latest data to actively engage on the topic and if necessary, vote with their feet by taking their business to those banks that are supporting global climate action.