Stockholm (NordSIP) – Despite market volatility in response to geopolitical tensions, US tariff threats and ESG pushback in the USA, institutional investors continue to search for asset managers to fulfil their investment mandates. According to Global Fund Search (GFS), a search platform for institutional asset owners, the first half of 2025 saw global institutional investors publish more requests for proposals than in the previous two half-year periods, a fact that was also true for Nordic investors. Nevertheless, the data also suggests that some caution may be warranted given the trend for searches according to EU classifications.

Searches for mandates referring to ESG factors also increased during the first half of 2025, particularly in the Nordics, where ESG searches accelerated to represent a significantly larger share of mandates than before.

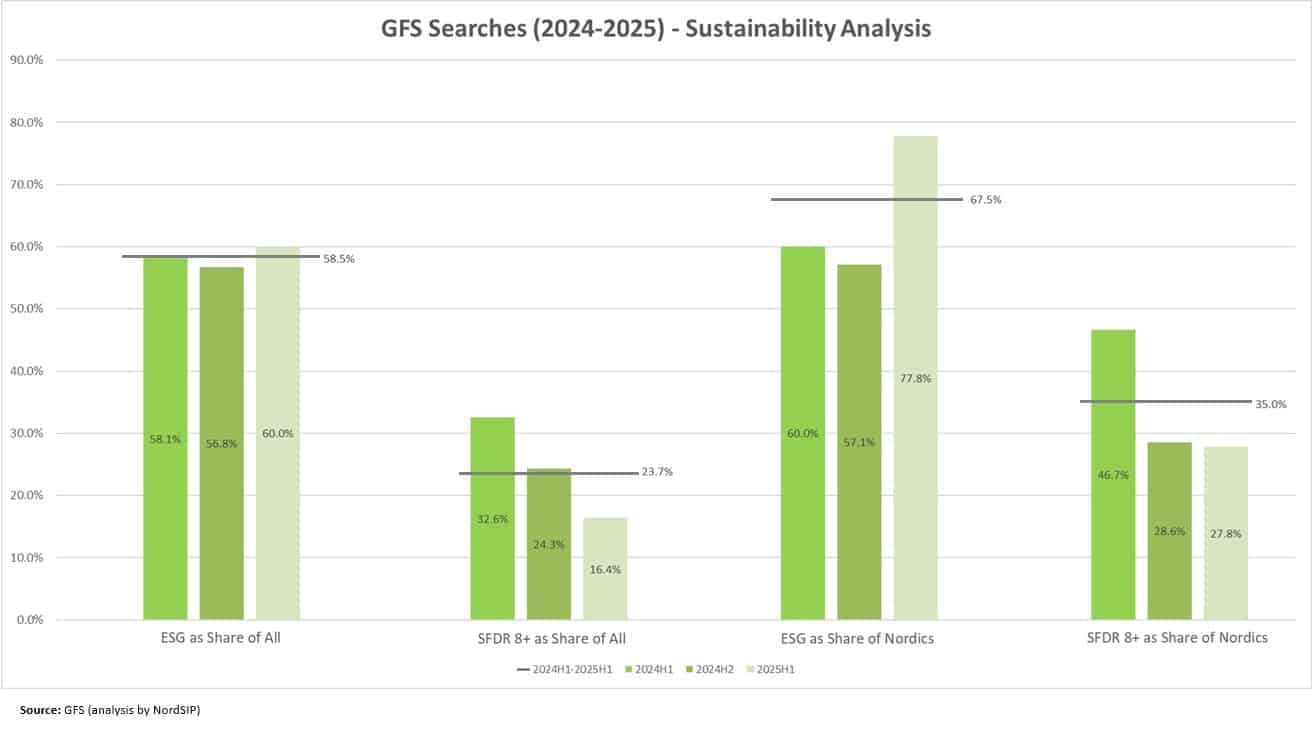

Between January 2024 and the end of June 2025, the number of mandate searches with some form of ESG classification represented over 58% of all searches on GFS’s platform. The relevance of ESG factors was considerably higher in the Nordics, where over two-thirds of the mandate searches took sustainability into consideration over this period. Most of this ESG growth appears to have been driven by a growth in the first half of 2025, particularly in the Nordics, where ESG mandates represented almost 78% of the searches. Although public equity market mandates were dominant, there was some diversity in the searches published on the platform, including real estate, private debt and private equity, infrastructure, as well as catastrophe bonds and natural capital.

Whilst encouraging, a deeper dive into further sustainability classifications provides a more nuanced view. Indeed, the share of global and Nordic searches classified as Article 8 or above under the EU’s Sustainable Finance Disclosures Regulations (SFDR) has fallen every half year since the start of 2024. Notably, searches classified as SFDR Article 8 and above focused overwhelmingly on public equity mandates, particularly in the Nordics.

Taken together, these two trends suggest that although investors might remain interested in sustainable products, they don’t necessarily feel themselves to be either bound or to benefit particularly much from pushing for the SFDR’s top classifications. This is consistent with some of the pushback that has been witnessed against regulation in Europe since the last European Parliament elections at the end of 2024, not least with the ongoing confusion with the Omnibus reforms.

Commenting on the data for this period, GFS’s newsletter considered ESG developments under the purview of thematic and alternative strategies, noting that these “remain niche but present, including natural capital, catastrophe bonds, and digital assets. These indicate growing institutional curiosity around non-traditional return sources and ESG integration.”