Stockholm (NordSIP) – As the world continues to wobble amid geopolitical crises, trade wars and rising temperatures, fixed-income markets remain one of the main barometers of the popularity and productivity of sustainable finance.

To that end, the first half of 2025 should provide the industry with comforting news. During the first six months of the year, global sustainable bond issuance across all currencies continued to grow positively. ESG bond issuance continues to be dominated by green bonds, issuance in Euro and China’s inaugural green bond, while Sweden continues to be the largest issuer among the five Nordic countries.

Green Bonds, Euro and China Dominate

During the first half of 2025, policy rates in the Eurozone and Sweden fell. The ECB cut rates four times from 3.4% to 2.4%. Unsurprisingly, given that the Danish krona is pegged to the euro, Danmarks Nationalbank followed the ECB’s lead and also cut interest rates. Riksbanken cut rates once on June 18th, from 2.25% to 2%. Although the Bank of England also cut rates twice, the US Federal Reserve has kept rates stable at 4,5%.

Between January and June 2025, global ESG bond issuance rose by 4% (vis-à-vis the same period last year) to reach US$584 billion, according to Swedbank. Issuance of ESG bonds in euros and Swedish krona reached its highest levels ever, reaching €249 billion and SEK 139 billion, corresponding to an 9% and 5% growth in issuance, respectively, vis-à-vis the same period last year.

Format-wise, the increase was driven by ‘use of proceeds bonds’ (Green, Social and Sustainability labelled bonds), while Sustainability-Linked and Transition format decreased. Sector-wise, 54% of ESG bonds came from public sector issuers (SSAs and municipalities), followed by corporates (23%) and the financial sector (23%). Geographically, Europe dominated with 45% of issuance, although Asia/Pacific increased its market share to 27%.

Perhaps the two most prominent SSA (sovereigns, supranationals and agencies) sustainable bond issues of this year came in the last days of June, when Poland returned to the green bond market for the first time since 2019 and Slovenia launched its inaugural sustainability-linked bond (SLB), the first one in Europe. In Asia, China made waves when it issued its inaugural US$850 million green bond at the end of the first quarter. At the end of January 2025, Kåpan and Skandia invested in the SEK 900 million bond from the International Fund for Agricultural Development (IFAD) issued under its Sustainable Development Finance Framework.

Enel, which was the first SLB issuer in 2019, issued a triple-tranche sustainability-linked bond (SLB) worth €2 billion on Monday, February 17th,2024. Among financial institutions, France’s BPCE’s €1 billion Green bond, issued in June 2025, is symptomatic of the sector’s continued relevance.

“Globally the Sustainable Bond market came out slow, but in the later part of the first half of the year showed great recovery and the market is 6% ahead of last years’ record issuance,” said Lars Mac Key, Global Head of Sustainable Products at Danske Bank.

Sweden Dominates the Nordics

According to Danske Bank, total Nordic ESG bond issuance was worth €37 billion, up from €31.5 billion for the same period last year. Sweden remained the dominant issuer, witnessing volumes worth over half of what was issued for all of 2024. Whilst a similar trend was observed in Finland, the opposite was true in Norway and Denmark, where ESG bonds as a share of all bonds issued appear to have fallen.

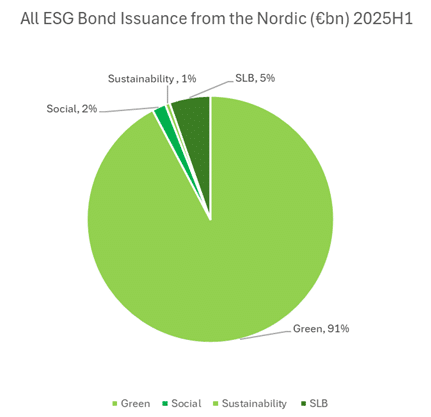

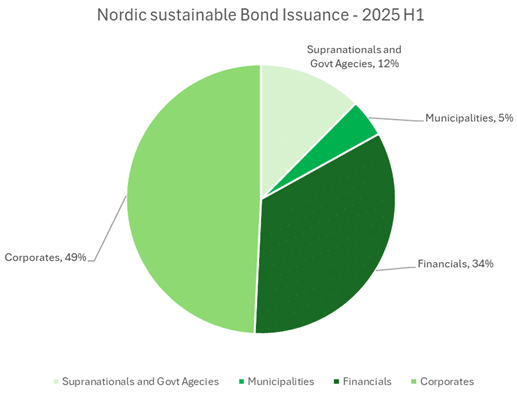

Green bonds were the preferred format in the Nordics, representing 91% of all ESG bond transactions, followed by SLBs (5.3%), social (1.8%) and sustainability bonds (0.6%). Sectorally, corporates continued to be the dominant sector, followed by financial and SSAs.

Among corporates, Sveafastigheter’s SEK 1.2 billion inaugural green bond issued in May 2025 and Heimstaden Bostad‘s SEK850 million green bond issued in February are good examples of the continued relevance of real estate companies in the market. Among Nordic SSAs, Helsingborg‘s SEK400 million SLB issued under its updated framework and focusing on social targets as well as Kommuninvest’s SEK3 billion social bond, stand out.

The Way Forward

Consistent with the figures above, 2025’s ESG markets appear to be on track to match last year’s performance, despite decreases in inaugural bonds.

“We expect issuance in line with 2024. On the one hand, there is an overall decrease in inaugural ESG bond issuers, and headwinds from macroeconomic and policy uncertainty. On the other hand, a significant size of ESG bonds are maturing in 2025-2026 (globally US$ 807 billion as of April 2025, corresponding to 16% of all outstanding ESG bonds), which should support issuance during the rest of 2025,” says Lucas Lindström, Sustainable Capital Markets analyst at Swedbank.