Stockholm (NordSIP) – According to the European Climate Neutrality Observatory (ECNO)’s 2025 State of EU progress to climate neutrality flagship report, the EU is making promising progress on the road to climate neutrality. However, much is still lacking if Europe is to achieve its goal of climate neutrality, not the least on the financial front. In this third edition of the report, ECNO analysed developments in over 150 indicators across thirteen areas of society.

According to the report, clean tech is the sector doing best. However, electricity, governance, just and fair transition were considered to be moving too slowly. This problem was even worse for the themes of mobility, agrifood, industry, CO2 removal, buildings, lifestyles, adaptation and external action. Finally, ECNO reserved (once again) a special place for the financial sector, which it assessed as moving in the “wrong direction”.

Finance Heading in the Wrong Direction

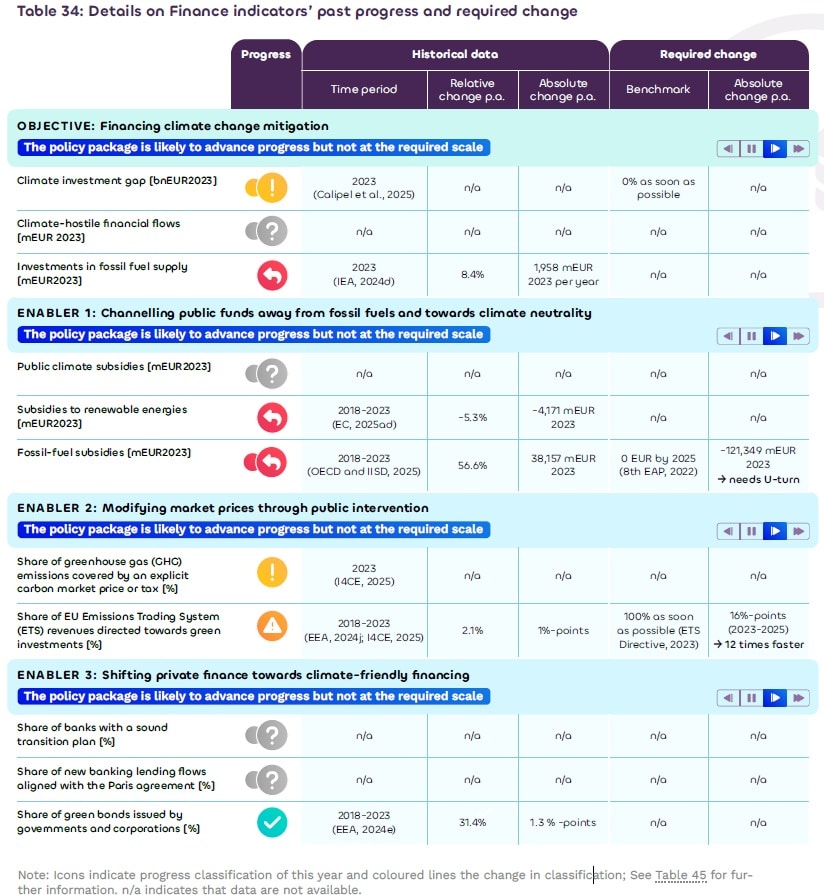

The misalignment of European finance with climate change mitigation was down to three hurdles: rising fossil fuel subsidies and inadequate carbon pricing.

“Finance is still moving in the wrong direction as financial flows remain misaligned with the

climate transition. This is visible in increasing investments in fossil fuel supply, persistent

fossil fuel subsidies, and a decline in subsidies for renewables,” the report argues. “This gap amounted to €344 billion in 2023 for the energy, buildings, transport, and cleantech manufacturing sectors – representing 40% of the needed investments between now and 2030 to achieve these targets. At the same time, fossil fuel subsidies rose by 19% in 2023 (compared to 2022 levels), reaching €242 billion. Finally, information regarding the amount of green transition financing by banking institutions remains limited, with the reporting quality and the publication of transition plans largely uncertain,” the report continues.

ECNO’s report notes that the evolution of fossil fuel subsidies varies widely among EU member states. Whilst German subsidies increased by up to 300% in 2023, they fell by 40% in Italy. However, these distinctions may be diluted when seen from a longer-term perspective. As the ECNO acknowledges, Italian subsidies had tripled in 2022 and German subsidies occurred in the context of capping energy prices.

Regarding the use of carbon pricing to facilitate funds towards climate change mitigation, the report notes several efforts to channel funds from the auction of carbon credits towards this end, particularly since 2023. However, ECNO warns that “transparency and accountability in reporting how EU ETS revenues are spent remain inadequate,” so despite improvements in the rules, it remains difficult to estimate the effect of these reforms. “To improve transparency and traceability, the EU should set up a strong framework to improve reporting on the allocation and spending of these revenues,” the report argues.

Lastly, the report singles out the last half-decade of regulatory efforts aimed at channelling private funds towards climate change mitigation. However, while it acknowledges the need to improve the EU’s competitiveness, the ECNO warns about the risks introduced by the recent Omnibus proposals. “The proposed Omnibus package could weaken oversight of the banking sector, as the Commission’s decision not to publish sector-specific standards may reduce scrutiny of banks’ financing of fossil fuels. While there is room to simplify and update the rules, the Omnibus package must not lower the ambition,” the report adds, echoing recent concerns by the ECB, among others.

An analytical consideration of the role of finance in climate change mitigation shows that one of the most important hurdles facing these efforts is the scarcity of available information.

Nordic Standouts

The ECNO report makes no specific reference to Nordic countries regarding the role of finance in facilitating climate change mitigation; it mentions Sweden and Denmark in other sections.

Regarding carbon capture and removal, it notes that “EU suppliers’ sales for immediate or future delivery of all technical removals have increased from almost nothing in 2021 (0.01 Mt CO2e) to 5.7 Mt CO2e in 2024.” However, it appears that 98% of this growth was driven by Bioenergy Carbon Capture and Storage (BECCS), mostly via offtake agreements with suppliers in Denmark and Sweden, which cover over 90% of all transactions by volume. Denmark is also highlighted in the report’s considerations of efforts to minimise agrifood emissions, where it is singled out habing developed or committed to plant-based action plans to ensure policy coherence.

Delving into the details of the financial indicators mentioned above shows that Finland is the single largest fossil fuel subsidiser, ranking 12th out of the 27 member states, with €1.1 bilion in subsidies in 2023, according to Eurostat. This is also problematic because of the three countries, Finland is the only one reporting an increase in subsidies over the last decade, with subsidies increasing by € 100 million since 2015. Sweden ranks in 12th place with € 9 million, down from € 1.1 billion in 2015. Denmark performs best out of the three, with only € 300 million worth of fossil fuel subsidies, half the amount reported for 2015.