Stockholm (NordSIP) – The future is bright for battery electric vehicles (BEVs) in the European Union (EU). That is the overall picture painted by the latest research published by Transport and Environment (T&E), an EU-funded non-governmental organisation (NGO) that campaigns for a cleaner and safer transport sector.

The EU Commission president Ursula von der Leyen recently indicated an intention to offer car manufacturers a two-year extension to the original 2035 zero-emission target for the sector. This means that internal combustion engine (ICE) vehicles can continue to be sold for longer, which according to T&E will lead to two million fewer BEVs being sold between 2025 and 2027. Although the delay has been supported by German manufacturer Mercedes-Benz, more than 150 senior executives from European BEV companies co-signed a letter urging the EU to maintain its original 2035 deadline or risk falling behind to overseas manufacturers.

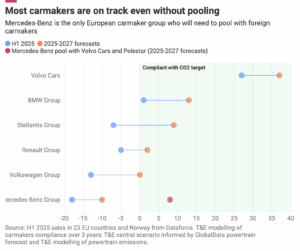

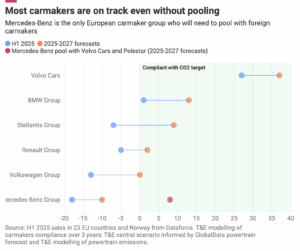

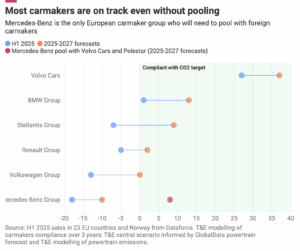

European car makers enjoyed a 38% increase in BEV sales over the first 7 months of 2025 and are generally on track to comply with CO2 targets. Mercedes-Benz is the exception, as the German firm would need to buy credits off Polestar and Volvo in a ‘pooling’ deal to reach the required standard. Mercedes-Benz hold the presidency of the European Automobile Manufacturers’ Association (ACEA), which has been lobbying the EU Commission to weaken its emissions targets. Mercedes’ failure to meet EU targets can be directly contrasted with the excellent performance of its domestic rival BMW. The latter is on track to be well below the maximum average emissions standards required by EU law between 2025 and 2027.

Although BEV pricing has been on a downward trajectory, the introduction of more affordable models slowed when the EU decided to phase in CO2 rules over three years. Nevertheless, the availability of cheaper batteries is expected to lead to the launch of 19 new BEV models with prices below €25,000 by 2027. The charging infrastructure is also keeping pace with BEV sales and is expected to grow by 90% by 2030 from a 2020 base level. 22 EU member states already boast twice as much charging power as required by EU law.

Despite the resistance of the ACEA and Mercedes-Benz, most manufacturers are wary of lagging behind China and other overseas nations in the race to electrify the transport sector. BEV market share in terms of sales has reached 30% in China and exceeded 40% in Vietnam, and European manufacturers would like to be part of the high expected growth in Asia, South America, and Africa.

Gothenburg-based Volvo is spearheading the BEV revolution in Europe and is well ahead of its competitors in terms of compliance with EU interim emissions targets. The company is firmly opposed to any delays as it believes this would hand the advantage to global competitors. Majority-Chinese owned Volvo is also highlighted by T&E for its industry-leading efforts to use low-carbon and recycled steel in its manufacturing process.

Stockholm (NordSIP) – The future is bright for battery electric vehicles (BEVs) in the European Union (EU). That is the overall picture painted by the latest research published by Transport and Environment (T&E), an EU-funded non-governmental organisation (NGO) that campaigns for a cleaner and safer transport sector.

The EU Commission president Ursula von der Leyen recently indicated an intention to offer car manufacturers a two-year extension to the original 2035 zero-emission target for the sector. This means that internal combustion engine (ICE) vehicles can continue to be sold for longer, which according to T&E will lead to two million fewer BEVs being sold between 2025 and 2027. Although the delay has been supported by German manufacturer Mercedes-Benz, more than 150 senior executives from European BEV companies co-signed a letter urging the EU to maintain its original 2035 deadline or risk falling behind to overseas manufacturers.

European car makers enjoyed a 38% increase in BEV sales over the first 7 months of 2025 and are generally on track to comply with CO2 targets. Mercedes-Benz is the exception, as the German firm would need to buy credits off Polestar and Volvo in a ‘pooling’ deal to reach the required standard. Mercedes-Benz hold the presidency of the European Automobile Manufacturers’ Association (ACEA), which has been lobbying the EU Commission to weaken its emissions targets. Mercedes’ failure to meet EU targets can be directly contrasted with the excellent performance of its domestic rival BMW. The latter is on track to be well below the maximum average emissions standards required by EU law between 2025 and 2027.

Although BEV pricing has been on a downward trajectory, the introduction of more affordable models slowed when the EU decided to phase in CO2 rules over three years. Nevertheless, the availability of cheaper batteries is expected to lead to the launch of 19 new BEV models with prices below €25,000 by 2027. The charging infrastructure is also keeping pace with BEV sales and is expected to grow by 90% by 2030 from a 2020 base level. 22 EU member states already boast twice as much charging power as required by EU law.

Despite the resistance of the ACEA and Mercedes-Benz, most manufacturers are wary of lagging behind China and other overseas nations in the race to electrify the transport sector. BEV market share in terms of sales has reached 30% in China and exceeded 40% in Vietnam, and European manufacturers would like to be part of the high expected growth in Asia, South America, and Africa.

Gothenburg-based Volvo is spearheading the BEV revolution in Europe and is well ahead of its competitors in terms of compliance with EU interim emissions targets. The company is firmly opposed to any delays as it believes this would hand the advantage to global competitors. Majority-Chinese owned Volvo is also highlighted by T&E for its industry-leading efforts to use low-carbon and recycled steel in its manufacturing process.