NordSIP (Stockholm) – As demand continues to grow for sustainable investment opportunities, one of the main hurdles facing investors is the difficulty to consistently assess and compare the potential impact of an investment. To meet this demand, the Cambridge Institute for Sustainable Leadership (CISL) has developed a new framework, which provides a set of impact metrics that translate the UN SDGs into measurable indicators that can be easily calculated, understood, and used by asset managers.

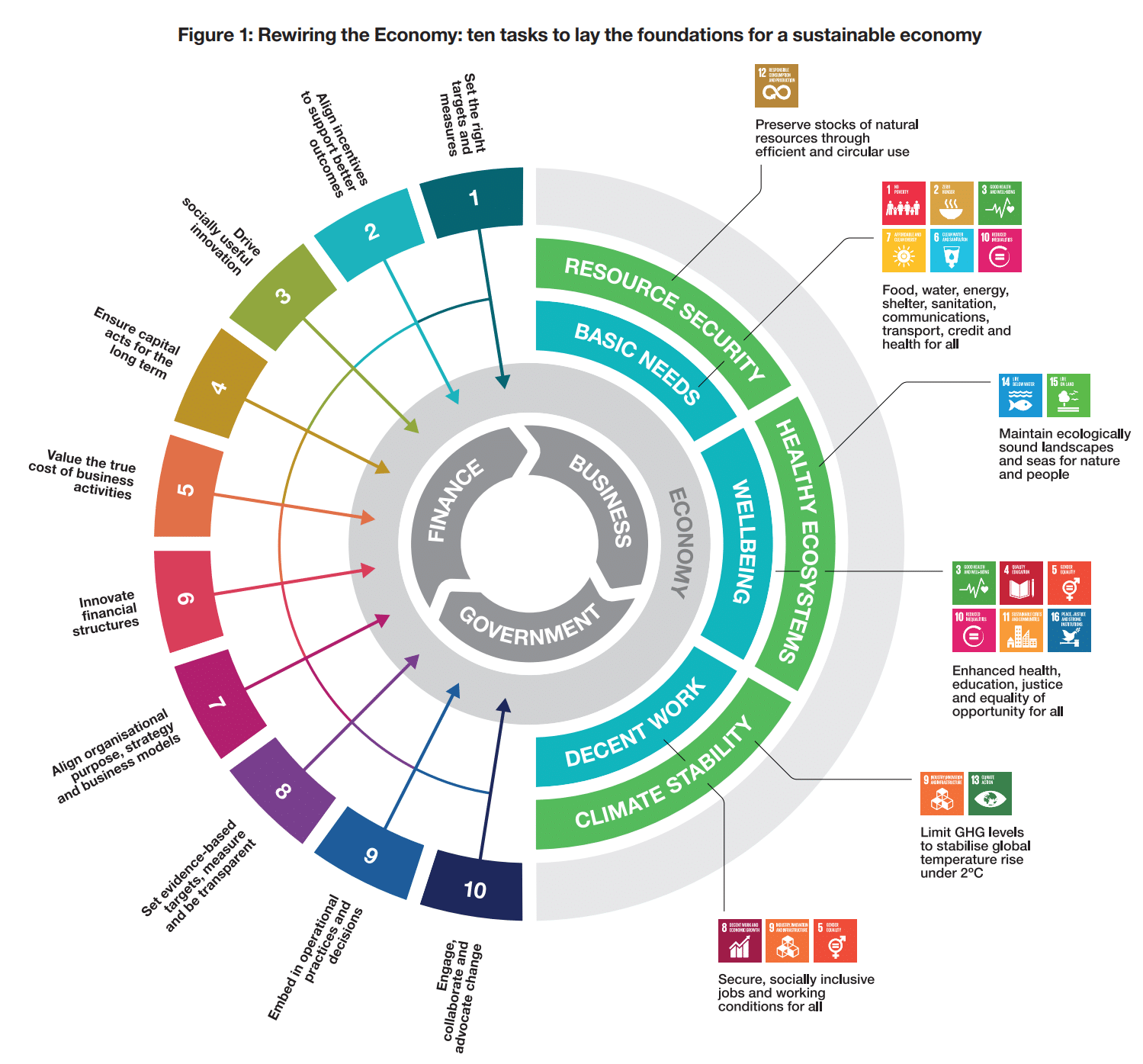

The CISL framework, originally published in 2016as In search of impact: Measuring the full value of capital, aimed to assist investors in understanding the alignment of their portfolios with the UN SDGs, through six impact themes (basic needs, climate stability, decent work, healthy ecosystems, resource security and wellbeing).

The new Cambridge Impact Framework refines the descriptions of the idealised ways in which impact should be measured and goes on to explore how far those measures can be applied to investment funds using currently available data.

One of the main advantages of the framework is that “it provides measures which are applicable in a standard way to all forms of investment, irrespective of style, asset class or geography.”

The assessment is done by focusing exclusively on the outcomes achieved by companies rather than on processes and on policies. For example, current data allowed CISL to assess climate stability according to the total amount of greenhouse gas emission (scope 1 and 2), resource security according to net waste and healthy ecosystems through fresh water consumption.

The authors specifically warned about the sub-optimal state of impact data today. “The practical metrics we offer (referred to as ‘base’ metrics) are pale shadows of our more theoretical ideal metrics. Despite their limitations, we decided to offer them as a practical means of getting started while improvements in data infrastructure and reporting are made throughout the industry,” according to the report.

The main difficulty facing CISL is data availability. “A complete set of taxonomies across all SDGs – currently the TEG only covers climate and a few environmental aspects – would help end users of financial products make fully informed decisions. This is currently not possible due to the lack of quality of disclosure,” says Kajetan Czyż, Programme Director, Sustainable Finance at CISL.

The hope is to spread the method across the industry. “We will work with industry associations, investors and fund platforms and are open to working with regulators and standard providers. Ultimately the industry also needs to demonstrate a willingness to use metrics such as the ones we proposed and work with CISL and others in this space to reach a consensus on what disclosure is required by corporates,” concludes Czyż.

The updated report can be accessed here.

Picture © Shutterstock.