Stockholm (NordSIP) – Following the peak issuance of 2021 fuelled by the COVID-19 pandemic, 2024 saw global sustainable debt issuance return to positive annual growth. To better understand the dynamics at play throughout the year and the dominant trends in the market, NordSIP reached out to the main Nordic dealers for comment.

Their answers provide some information on the performance of the market in 2024 and highlighted the continued commitment of the region to sustainable bond issuance, while noting the upcoming wave of bonds reaching maturity and the risks created by ongoing macroeconomic and geopolitical events.

Financials and SSAs Dominate

In 2024, global sustainable debt issuance reached US$1.631 trillion, of which US$1.166 trillion came from bonds alone, according to data SEB shared with NordSIP.

According to Swedbank €369 billion of issuance in 2024 can be attributed to issuance denominated in euro. Among Nordic currencies, issuance reached SEK 283 billion and NOK99 billion in 2024. Sovereigns, Supranationals and Agencies (SSAs) were the largest issuers in EUR, followed by corporates and financial institutions. In SEK, financials were the largest issuers, followed by real estate companies.

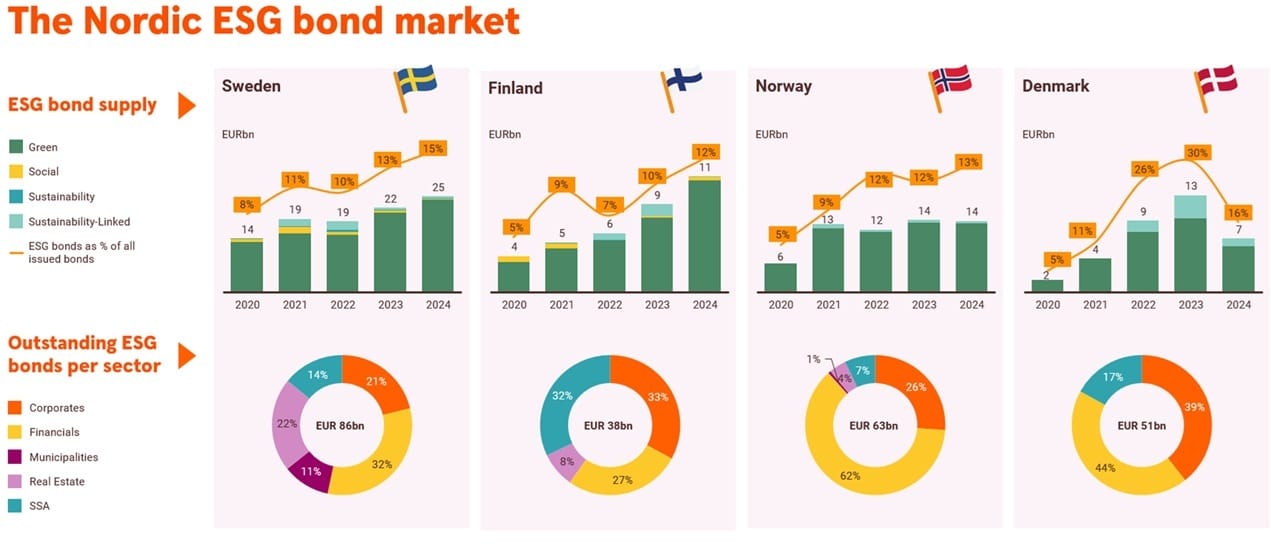

Over the last six years, the Nordic sustainable bond market grew from €9.6 billion in 2018 to €57.2 billion in 2024, according to data shared by Danske Bank Debt Capital Markets team. The Nordic sustainable bond market has grown substantially over the last seven years and is more diverse today, with 179 issuers at the end of 2024, than it was in 2018 with its original 37 issuers.

Sweden Continues to Lead

In 2024, Sweden remained the dominant country for Nordic sustainable bond issuance, with €25 billion, according to Swedbank. Financial institutions, including deals worth €750 million by Nordea and SEK 10 billion by Swedbank Hypotek led the way, followed by the real estate companies, such as Vasakronan which issued approximately SEK6 billion in 2024.

Norway came second with €14 billion, with significant transactions from DNB, Statkraft and KBN. Finland came third, with corporates on top, with deals such as Sanoma’s €150 million social bond, Finland’s first ever corporate social bond, issued in September; a €600 million green bond focused on sustainable forest and plantation management from UPM, in October, and Citycon’s €350 million green bond in December, which saw the largest spread tightening during the year in the senior IG space. The second most important category of issuers from Finland was SSAs, including a US$1 billion green benchmark from MuniFin and a 5-year €750 million NIB Environmental Bond (NEB) issued by the NIB in September.

Green Bonds Still Preferred

Globally, from a product type perspective, green bonds continue to be the most significant form sustainable bond issuance, followed by sustainability bonds, social bonds and sustainability-linked bonds. Transition bonds have started making an appearance in 2024, but still represent a very small fraction of the market.

The Nordic market is traditionally more concentrated around green bonds than its global counterpart. 2024 was no exception, with sustainability-linked bonds (SLB) only making a small contribution to a market otherwise dominated by green bonds.

The situation is similar when only considering the last quarter of the year. According to data shared by Swedbank, ESG bond issuance issued in the last quarter of 2024, was worth approximately €14 billion and dominated by green bond format. In the same period, ESG bond issuance conducted in SEK was worth SEK69 billion, with over 90% conducted in green bond format.

The Dealers View

Globally, BNP Paribas was the top manager for sustainable bond issuance for the whole of 2024, followed by Citi, JP Morgan, HSBC and Deutsche Bank. Among the Nordics, Danske Bank came first in 23rd place globally (with €12 billion), followed by SEB (in 25th place globally, with €10.666 billion) and Nordea (in 30th place globally, with €8.7 billion). A similar ranking was patent when considering only green bonds.

Cautious Optimism

Going forward, expectations remain positive regarding bond issuance in 2024m although some caution is warranted regarding macroeconomic and geopolitical developments.

“We expect FY 2025 to bring in slightly higher ESG issuance in terms of size vs. 2024. On a positive note, we see lower interest rates being supportive for further issuance, especially among corporates, in addition to significant volumes of ESG bonds maturing. A limiting factor could however be the macro and geopolitical landscape,” says Lucas Lindström, Sustainable Capital markets analyst at Swedbank.

“For 2025, we expect a busy issuance year both in the Nordics and in EUR market given the upcoming sustainable bond maturity wall as well as investor positioning and expectations for sustainable bonds,” says Janne Koivula, Associate, DCM Sustainable Bonds at Danske Bank Capital Markets. Finally, Koivula also pointed to Danske Bank’s EUR IG Credit Investor Survey, where 85% of respondents expect to have more ESG capital to deploy in 2025. 61% of the repondents also revealed they were willing to accept a greenium. In addition, 33% are willing to accept an extra greenium for EU Green Bonds.