When Trump was elected, many in the market naturally worried that his aversion to ESG would negatively affect the sustainability agenda. However, the forecast was mixed, making a clear distinction between his impact on new projects, which he could stop, and many of the existing projects supported by the Biden White House under the Inflation Reduction Act, which he would struggle to stop.

From the perspective of sustainable investments, the fear was that the actions of the Trump Administration would in some way undermine their returns. In the end, thanks to his trade wars and flip-flopping on trade tariffs, it turned out investors were right to be afraid but so was everyone else. Ultimately, it appears that from a top-down financial markets perspective, the Trump Administration has not (yet) altered the fundamental relationships between sustainable markets and the standard benchmarks that they track. Because they comove, ESG investments are still unable to provide a hedge against standard investments. They might, however, have become an even better shield against volatility.

Trump Is Chaotic for Everyone

The good news, for those fearing that Trump would be particularly damaging for sustainable investors, is that he is not. The bad news is that his first quarter in power was damaging for everyone, including sustainable investors.

The figure below shows the evolution of the S&P 500 and its ESG counterpart over the last twelve months. After peaking at the start of February, the SP500 went into a nose dive and has only recently recovered.

Fixed-income markets, captured by the evolution of the iShares ETF tracker of the Bloomberg Barclays MSCI Global Green Bond Index (BGRN) and the iShares Core U.S. Aggregate Bond ETF (AGG), moved in the opposite direction to their stock counterparts, reflecting a typical trend.

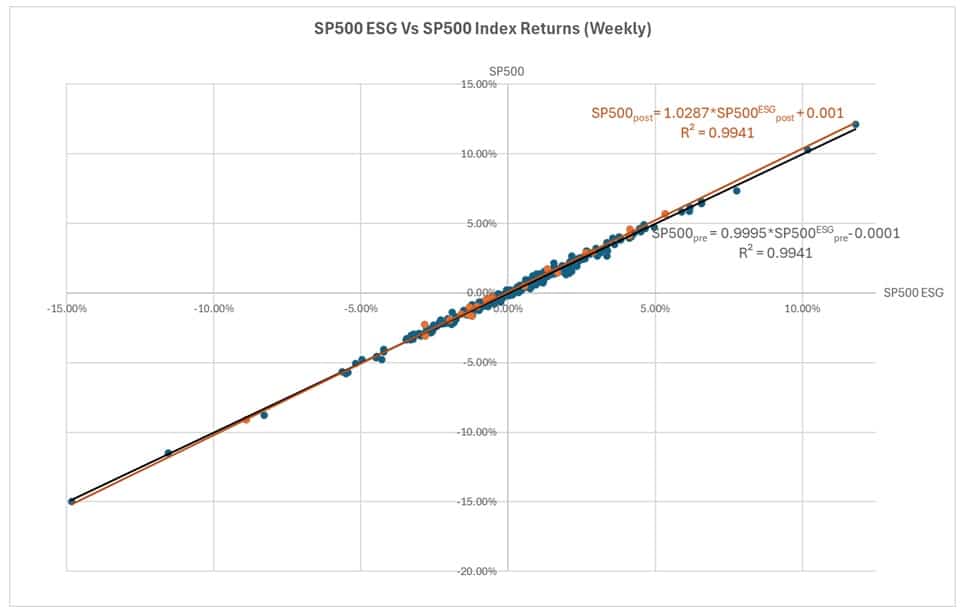

The scatter plots below further illustrate these dynamics. Fundamentally, there is no evidence of any relative benefit or particular damage from the Trump administration on ESG indexes, which have continued to move in tandem with their standard market benchmarks.

As the figures below show, there is no instance of a tradeoff between the sustainable and non-sustainable versions of these comparable indices. Disruptive though the second Trump administration might be, there is no evidence, based on these two pairs of indices, that it is in any way changing the fundamental nature of the relationship between sustainable and non-sustainable indices. In 2025 (orange dots and line), the S&P 500 and its ESG version continue to move in tandem, enjoying much the same positive relationship as in 2024 (dark blue dots and black line).

Source: NordSIP, based on investing.com dataThe same observation holds in fixed-income markets. Although some of the dispersion in the scatter plot below seems to imply some idiosyncratic trade-offs for returns below -0.5 and 0.5%, these are idiosyncratic instances rather than part of a systematic relationship.

Source: NordSIP, based on investing.com data

What About Risk?

If one was to make any inference of changing dynamics it would have to be that the relationships appear to be steepening. While it might be premature to make too many generalisations based on the 20 weeks of the year only, this may suggest that the returns of ESG indices move within narrower bands, while those of standard indices move more widely since the start of the year.

If this is the case, the conclusion is not only that Trump has introduced more volatility to the markets. It could also be that investors looking to minimise volatility might find renewed appeal in ESG products. This arches back to a classic point in favour of ESG investments: they are less risky. Comparing standard deviations shows that this is indeed the case, for the most part.

Not only do returns tend to be less volatile for ESG indices than for their standard counterpart, the standard deviation of all indices has increased since the end of the year. The only exception is for S&P 500 ESG returns, which appear to have been more slightly more volatile than those of the standard S&P 500. But even in that case, the index has been more volatile in 2025.

Calm in the Eye of the Storm

ESG investments are in the eye of the Trump storm. They are a target for criticism and reactionary threats. As it stands, financially speaking, they do not seem to be able to provide much in the way of excess returns.

It is impossible to know how the dynamics between sustainable and standard investments will progress going forward. However, for now, investors looking for stability in times of chaos might find some calmer waters in sustainable markets.