Stockholm (NordSIP) – In a recent series of articles, NordSIP commented on the decisions of the Swedish fund selection agency, Fondtorgsnämnden (FTN), and the fact that it seemed unwilling to procure more funds with “sustainable investment as their objective”, as per Article 9 of the EU’s Sustainable Finance Disclosures Regulation (SFDR).

In response to NordSIP’s coverage, FTN reached out to clarify some of the details, both with regards to its fund platform, its actual procurement, as well as to the processes behind it. FTN’s feedback helps understand the scarcity of Article 9 funds as well as to put it in context. As it turns out, relatively speaking, FTN’s procurement of Article 9 funds does not appear to be an outlier.

Does FTN Host Article 9 Funds?

The first clarification has to do with the fact that FTN has actually procured Article 9 funds. The premium pension fund platform hosts a total 409 funds. However, only 29 of these funds actually went through FTN’s procurement process since FTN was set up in 2022*. Of these, three are Article 9, since October 2024. Of those, two are global index funds and another is a European-focused index fund.

Detailed information on these funds can be found on pensionsmyndigheten’s website. All three of the passive funds are managed by Handelsbanken. The two global index funds are Handelsbanken Developed Markets Index Criteria A1 and the Handelsbanken Global Index Criteria A1. The European Index fund is the Handelsbanken Europe Index Criteria A1. It should be noted, however, that there are no actively managed Article 9 funds, nor any such funds focused exclusively on the Nordic region or Sweden.

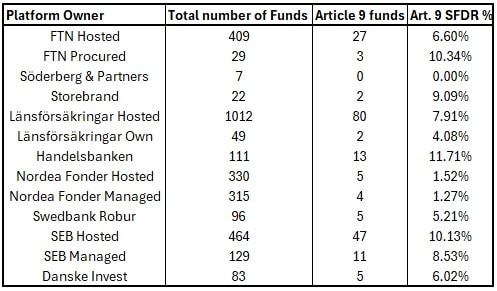

FTN is not an outlier in terms of the share of its funds that are Article 9. At 3 Article 9 funds out of 29 procured funds, it is actually one of the best, relatively speaking. FTN has a wider offering than Söderberg & Partners, who only lists 7 funds all of which are Article 8. Storebrand’s list of 22 funds¹ only includes 2 Article 9 funds: Storebrand Global Solutions and Storebrand Grön Obligation. Länsförsäkringar offers 80 Article 9 funds, out of a total 1012 funds on their platform. However, of these, only 2 Article 9 funds are a part of the 49 funds managed by Länsförsäkringar’s own funds. 13 of the 111 funds on Handelsbanken Fonder’s platform are aligned with Article 9. Of the 315 Nordea funds listed on Nordea Fonder’s platform, only 4 could be identified as Article 9 ². Swedbank Robur lists 5 Article 9 funds out of all 96 funds listed on their platform. Of the 464 funds listed on SEB’s website, 47 are Article 9 funds. Of the 83 funds listed on Danske Invest’s website, 5 are Article 9 funds ³.

The Benefits and Costs of Low Fees

Another point that FTN sought to clarify was why its selection criteria diverge from those of Morningstar’s ratings, which tend to be used as a benchmark for fund selection choices. In a recent article, we had noticed that “curiously, the selection criteria FTN has used do not appear to have any correlation with third-party assessments such as Morningstar performance ratings, its forward-looking ‘medal’ assessment nor the analytics provider’s sustainability globes.”

The main reason for this divergence is the low fees available to FTN and how much they weigh in the selection process. “One of the benefits of saving in funds through FTN’s platform is the fact that it provides retail investors with some of the lowest fees available, if not the lowest available fees,” says Viktor Ström, Head of Communications at FTN (Pictured).

“The average procured fees has so far been far below the retail fee for the same set of funds. For example, in the newly procured category actively managed Swedish equity funds, the average fee is 0.154%, roughly 1 percentage point lower than the retail fees for the same set of funds on Morningstar,” Ström says.

“Morningstar uses the retail fee when calculating historic performance, rating and alpha forecasting. This means the procured funds will have roughly 1 percentage point higher annual return compared to what you’ll see on Morningstar. Since the return looks lower this also effects the star rating and since the fees are lower this effects the alpha forecasting used when calculating Morningstar medals. For index funds the difference is smaller, but still relevant. In the Swedish equity index category the average procured fee is 0,039 percent, about 0,18 percentage points lower compared to the retail fees,” Ström says.

Volume, Fees, Growth and Quality

According to Ström determining the number of funds to be procured within a category is ultimately a balancing act involving several factors. FTN does not take into consideration the present number of funds it hosts in any given category, but it does care about volume, growth expectations, quality and diversity.

Volume matters because FTN is looking for low fees and because it seeks to match market segments with the market’s existing capital allocation. “Volume matters because we want the ticket size to be large enough for tenderers to offer a low fee. All things being equal, fewer funds in a category give larger ticket sizes and lower fees,” Ström explains.

Additionally, FTN needs to consider its growth expectations for the fund platform. The premium pension fund platform is projected to experience annual inflows for decades to come. The premium pension was launched only 25 years ago and is still growing. This means most savers in the system are still working and therefore will generate a net inflow of capital until about 2060. After 2060 the system will be mature and in balance in terms of inflows/outflows. “As a result, we must take into account potential fund or market constraints. For example, Swedish small-cap funds face certain capacity constraints. Because of this, we are likely to aim for a higher number of funds in that category than we would if there were no such limitations,” Ström adds.

“It is also important to note that quality tends to diminish as the number of funds increases. If there is a limited supply of, for example, Swedish small-cap managers, procuring more funds will generally lower the average quality,” Ström says. This criterion requires some clarification. FTN considers funds to be high quality if they are managed by competent staff within a capable organisation, possess a robust and consistently applied investment philosophy, and integrate sustainability throughout their process to achieve strong risk-adjusted returns over the long term – and thereby are likely to generate alpha or, for index funds, a return close to the benchmark index. FTN assesses funds based on mandatory criteria, including suitability, cost-efficiency, sustainability, and controllability, to ensure they are high quality, meet legal requirements, and contribute to a safe pension system

Freedom of choice is also an important fact. “We also take into account that the fund platform as a whole should offer savers freedom of choice in terms of different risk levels and investment focus. But this is mainly addressed by procuring many different categories rather than many similar funds within the same category,” Ström continues.

Will FTN Purchase More Article 9 Funds?

To a degree, the aforementioned criteria can be seen to conspire against the selection of Article 9 funds by FTN. If the supply of high quality Article 9 funds is low, it is harder for FTN to procure them since, legally, it only can procure high quality funds. The extremely low fees may also push some article 9 fund managers away. Nevertheless, FTN does not have any limit on fund AUM, so the fact that Article 9 funds might be small is not necessarily a factor.

For now, FTN is somewhat non-commital but is not closing the door on Article 9 procurement. “FTN is considering the possibility of doing a separate sustainability procurement funds,” Ström tells NordSIP. The inclusion of more funds of this type would clearly broaden the range of funds with different investment orientations and increase freedom of choice for Swedish savers. Until then, we’ll be waiting.

*FTN hosts 409 funds of which 27 are Article 9 funds. Of the 409 hosted funds, 29 actually went through FTN’s procurement process. Of the 29 funds that are hosted and went through FTN’s procurement, there are three funs that report under Article 9 SFDR.

¹Storebrand’s fund platform includes a total of 32 funds. Of these, 22 are sold under the Storebrand name, 9 under SPP and one under another name.

² Nordea’s fund list hosts 330 funds. Of these, 315 are presented under the Nordea label, mainly as “Nordea Investment Funds, Luxembourg” or “Nordea Funds, Finland”. The remaining 15 funds are managed by Schroder Investment Management, Wellington, JPMorgan, Robeco or BlackRock. Moreover, Nordea’s fund list website does not filter for SFDR or sustainability by default. Article 9 funds were identified based on plausibly relevant names that included the words “impact”, “sustainability” or “ESG”. Of the 28 funds that fit those criteria, only five appear to report under Article 9: Nordea Global Impact Fund BQ, Nordea European Corporate Sustainable Labelled Bond Fund HBQ, Nordea European Sustainable Labelled Bond Fund HBQ, Nordea Global Sustainable Listed Real Assets, and the Robeco Sustainable Water.

³ Danske Invest’s fund list website does not filter for SFDR or sustainability by default. Article 9 funds were identified based on plausibly relevant names that included the words “impact”, “sustainability” or “ESG”. Of the 83 funds that fit those criteria, only five reported under Article 9: Danske Invest European Corporate Sustainable Bond Class A-sek h, Danske Invest Emerging Markets Sustainable Future Class A-sek, Danske Invest European Corporate Sustainable Bond Class A-sek h d, Danske Invest Global Sustainable Future Class A, and Danske Invest Global Sustainable Future Class A-sek.