Stockholm (NordSIP) – On 27 August, the Swedish Fund Selection Agency (FTN) announced the outcome of its procurement process for actively managed and passive Swedish equity funds on the premium pension platform.

According to FTN’s official statement, on the active side, ten funds from seven different managers have been awarded agreements, five of which are returning to the platform and five newly added. In total, approximately SEK 92 billion of pension capital will be allocated to these mandates.

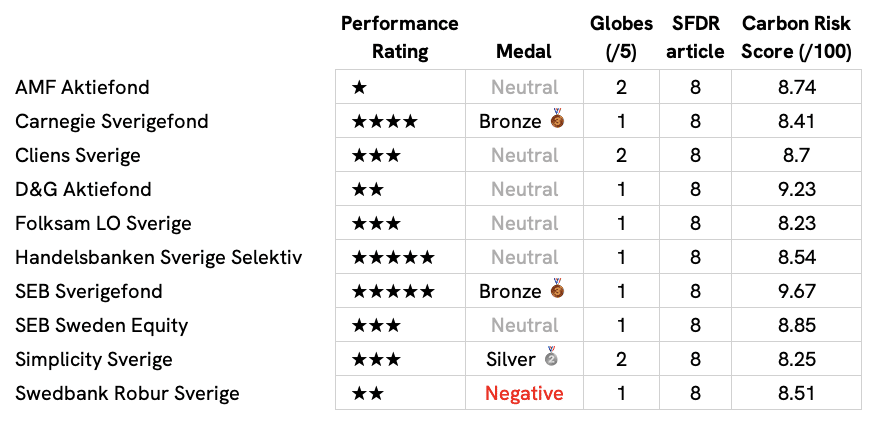

These actively managed funds are: AMF Aktiefond Sverige, Carnegie Sverigefond, D&G Aktiefond (also managed by Carnegie Fonder), Cliens Sverige, Handelsbanken Sverige Selektiv, SEB Sverigefond and SEB 3 – SEB Sweden Equity Fund, Simplicity Sverige, Swedbank Robur Sverige and Folksam LO Sverige (also managed by Swedbank Robur Fonder).

“These are high-quality funds with potential for strong long-term returns – and generally low fees,” commented Mats Dillén, Chairman of the Swedish Fund Selection Agency, in the LinkedIn announcement. Erik Fransson, Executive Director, added that “the level of competition was high, and all awarded funds met strict legal and sustainability requirements.”

SEB Asset Management, who took two of the final ten spots proudly commented in a press release: “That our funds are selected in the procurements is proof that they meet the breadth and quality sought by the Agency, with the potential to deliver good returns over time,” said Javiera Ragnartz, Head of SEB Asset Management (in Swedish).

The evaluation process conducted by FTN involved a rigorous assessment of each candidate’s investment process, operational capacity, and cost structure. Sustainability was a central component, with funds required to demonstrate clear integration of ESG considerations, as well as compliance with international standards and Swedish regulatory expectations. The agency stressed that only those managers meeting both financial and non-financial criteria were selected, underscoring the growing importance of responsible investment practices in public pension allocations.

Curiously, the selection criteria FTN has used do not appear to have any correlation with third-party assessments such as Morningstar performance ratings, its forward looking “medal” assessment nor the analytics provider’s sustainability globes. While we understand that past performance is no guarantee of future return, we are left wondering why none of the selected funds have a gold medal, which according to Morningstar would have received the highest conviction from its own analysts about he fund’s ability to outperform peers of benchmarks in the future.

We are also puzzled about the lack of choices for more sustainable options. While all the funds achieve a relatively low Carbon Risk Score according to Morningstar, none of them achieve more than 2 Morningstar sustainabillity “globes”. While these ratings have attracted criticism in the past for reflecting a partial view on sustainability, the Swedish pension savers might have benefitted having at least some choice. We also found no SFDR article 9 funds among the ten selected products. Unfortunately, this decision might have been driven by the small number of funds available. On Avanza’s platform, it appears that only 3 Swedish-focused funds are currently claiming compliance with article 9, some of which are not purely Swedish funds: Carnegie All Cap, Indecap Guide Q30 and Ruth Core Nordic Small Cap.

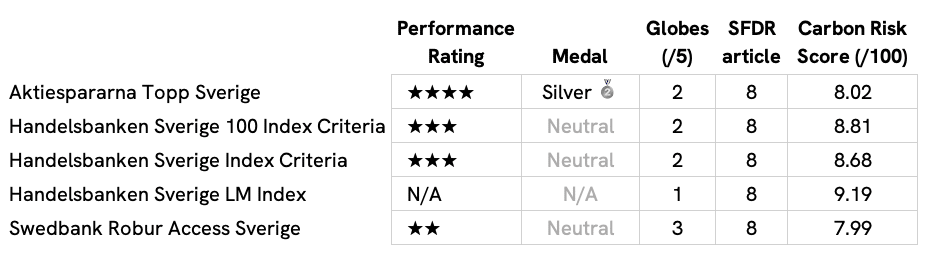

On the passive side, the FTN chose five funds managed by three different firms. SEK 65 billion of pension capital will be allocated among them. These passive funds are: Aktiespararna Topp Sverige, managed by Cicero Fonder, Handelsbanken Sverige 100 Index Criteria, Handelsbanken Sverige Index Criteria, Handelsbanken Sverige LM Index and Swedbank Robur Access Sverige.

The selection appears to follow the same pattern as on the active management side, except that, somewhat counterintuitively, it is in the passive selection that savers will be able to find the fund with the highest number of sustainability globes.

According to FTN, the awarded funds will be integrated into the platform in due course, with further details to follow as the agency continues to refine its fund selection framework.