Stockholm (NordSIP) – A survey carried out by Global Impact Investing Network (GIIN), reflects 229 respondents’ perspectives on the growth and development of the impact investing industry. GIIN usually chooses several hot topics and discusses them with the respondents each year and attention is paid to impact washing, emerging technology, governmental policy and blended finance this year.

We have selected the highlights here:

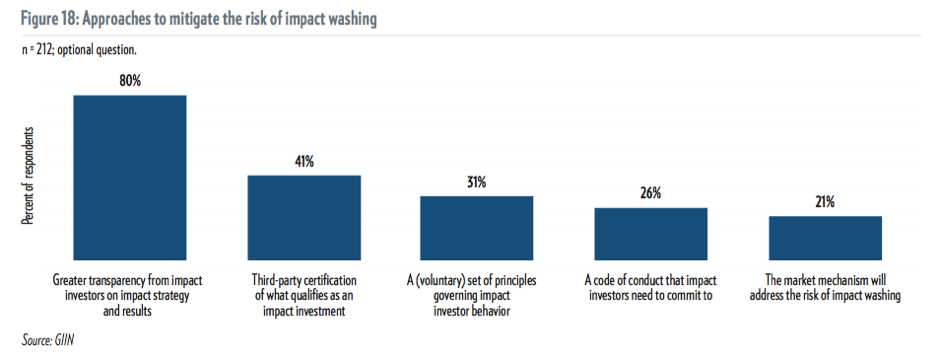

- Impact washing: 80% survey respondents agreed that “greater transparency from impact investors on impact strategy and results” will mitigate the risk of impact washing.

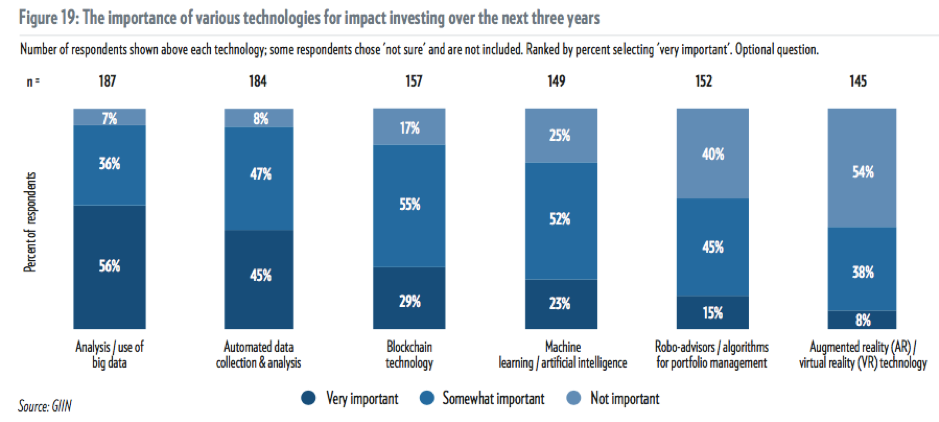

- Technology: Respondents expect the most important technologies to be analysis & use of big data (56% rating this ‘very important’) and automated data collection and analysis (45%).

- Policy: The most significant government action or policy is “provision of credit enhancement” for respondents.

- Blended finance: 25% of respondents have either participated in a blended finance deal or plan to do so.

229 respondents currently manage USD 228.1 billion in impact investing assets. The report includes analysis of these respondents’ investment activity, asset allocations, impact measurement practices, and performance. The findings not only show the market is diverse and growing, but also illustrate that impact investors have a strong commitment to measuring and managing impacts and they report performance in line with both financial and impact expectations. Simultaneously, impact investors acknowledge remaining challenges that need to be addressed within the industry.

To remain informed of the quickly-evolving impact investing industry, the Research Team also gathered practitioners’ insights on key developments and ‘hot topics’.

- Preserving impact integrity

Respondents shared their views on how to mitigate the risk of ‘impact washing’, i.e. that some actors may be adopting the label without meaningful fidelity to impact. 80% respondents agree that “greater transparency from impact investors on impact strategy and results” will mitigate the risk of impact washing and 41% support that “third-party certification of what qualifies as an impact investment”. 31% and 26%, respectively, agree that shared principles or a code of conduct are potential approaches. Interestingly, 21% believe that no action is necessary because ‘the market mechanism will address the risk of impact washing’.

In terms of what a shared set of principle or code of conduct might look like, respondents support that investors should target at the investments that positively address one or more social or environmental challenges (92% rating this ‘very important’) and should clarify the “time of investment” (76%) and “measurement of progress against impact goals at regular intervals throughout investment” (76%).

- Technology

High-tech development draws the world’s attention and many stakeholders wonder how the technological advancement can affect impact investing. This survey shows impact investors’ prediction of the importance of various technologies for the field over the next three years. Many investors believe the analysis of big data (56%) and automated data collection & analysis (45%) are very important but some show an uncertain attitude towards blockchain technology and machine learning/artificial intelligence (around half rating this ‘somewhat important’). Moreover 40% (54%) respondents consider a weak connection between Robo-advisors (AR/VR) and impact investing.

- Policy

Government policy can encourage or deter investors to make impact investments. “Provision of credit enhancement” is ranked as the most important government action or policy. “Tax credits or subsidies for investors”,” funding for technical assistance for investors”, “co-investment by government agency” are also valued highly by respondents.

Many respondents commented on which current events (political or economic) have influenced their impact investing strategy or goals. Many noted the Sustainable Development Goals (SDG) have played a key role. Some specific country contexts such as the political environment and economic downturn in Brazil are also mentioned by respondents.

- Blended Finance

Blended finance is a strategy that combines capital with different levels of risk in order to catalyse risk-adjusted, market-rate-seeking capital into impact investments. 25% of respondents have either participated in a blended finance deal or plan to do so while a quarter of organizations not. 45% of these organizations attribute their non-participation to such deals that do not fit their investment models and others regard they have not yet found the right deal (23%) or co-investors (20%).

Source: GIIN

Download the whole report here

Picture available on Pexels