Stockholm (NordSIP) – Following our assessment of Swedish Article 9 global equity funds for 2022, NordSIP decided to cast a wider net for the first quarter of 2023 and consider the performance of all Global, European and Nordic sustainable retail funds registered in Sweden, managed by Nordic asset managers.

The second iteration of NordSIP’s review of equity funds classified as Article 9 under the EU’s Sustainable Finance Disclosures Regulations (SFDR) covers the performance of 18 global funds based in the Nordics available to retail investors in Sweden during the first quarter of 2023. The new participants in the survey include global funds from DNB, Nordea, FCG Norron, Simplicity and Odin and Danske Bank.

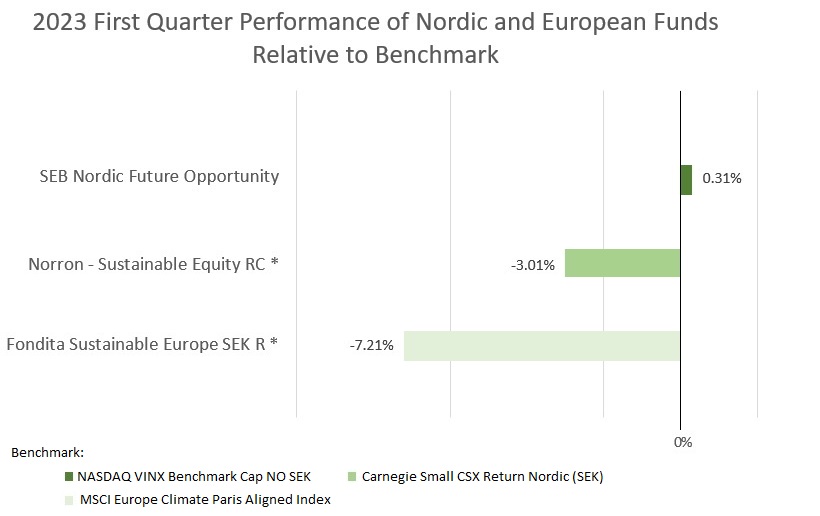

Three Nordic- and Europe-focused funds from SEB, Norron and Fondita were also identified for separate analysis. The addition of these new participants to the market survey also brought in new benchmarks from S&P Global, Morningstar and Solactive, even if the MSCI ACWI and the MSCI World remain the most popular references for fund performance.

Note: “Starred” (“*”) funds refer to instances where the fund does not have an official benchmark. For comparison purposes, the fund managers of the respective funds provided a suitable index. For more information, please refer to the footnotes at the end of the article.

Amid rising interest rates, persistent inflation and fears of an expanding banking crisis in the USA, a volatile but (broadly) stagnant US Dollar and a rising Euro, portfolio managers provided a heterogeneous range of performances. They highlighted the positive and negative contributions of renewable energy, IT, materials, consumer discretionary and European financial stocks and the role of the Inflation Reduction Act (IRA) as the main drivers of returns.

The Power of Renewable Energy, Electrification and Growth Stocks

Portfolio managers repeatedly emphasised the role of overweighting companies in the renewable energy and electrification sectors as explanations for the success of those funds that outperformed their index.

Discussing the performance of the Simplicity Green Impact fund, portfolio manager Johanna Ingemarson chose to highlight the contributions of renewable energy and electrification companies. “Simplicity Green Impact kicked off 2023 with a strong first quarter. The fund performed better than both its broad global benchmark index and clean energy indexes. First Solar, Ecopro, and Encore Wire are examples of fund holdings that contributed strongly to the fund’s performance during the period,” Ingemarson said.

Regulatory and policy developments remained top of mind. “In 2023, companies have reported their alignment with the EU taxonomy for the first time. We have closely followed the development of the regulation as well as companies’ taxonomy-reporting and are very positive towards the increased transparency on sustainability that the EU taxonomy has provided so far. In March, the European Commission proposed the Net-Zero Industry Act (NZIA) to strengthen and increase the competitiveness of the EU’s position in the global clean teach race. We welcome NZIA as an important investment opportunity for our fund holdings along with the corresponding US Inflation Reduction Act (IRA) of 2022,” Ingemarson added.

Developments in the electrification sector were also worth paying attention. “The price decline of electrification metals, such as copper and lithium, continued in the first quarter of 2023, which negatively pressured companies involved in the production of the metals. On the other hand, the price decline could offset margin pressure and provide consumer cost savings for clean tech products, such as solar, wind, batteries, and electric vehicles, which we see as important factors driving growth of green investments going forward,” Ingemarson argued.

Storebrand Global Solutions A Fund’s portfolio manager Phillip Ripman agreed that renewables remain an important theme thanks to state support. “While the renewable segment continues to be volatile, it is important to note that state level conditions continue to add tailwinds. At the very end of March, the EU reached a provisional deal on higher renewable energy targets. The previous target was 32% renewable energy share, where an increase to 42,5% is now on the table,” Ripman explained. Regarding the performance of the fund, Ripman noted that “Smart Cities was the best-performing theme over the period, followed by Equal Opportunities and Circular Economy,” Ripman added. “The fund continues to seek thematically strong companies, and saw an opportunity to strengthen its position in renewable energy after valuations have come down recently. We also strengthened exposure to other parts of the value chain such as solar trackers and less polysilicon-reliant solar modules. Q1 was challenging within the energy production segment, which is one of the fund’s sub-themes. Particularly, companies connected to residential solar panel installations in the USA were affected by higher interest rates and modified installment plans, as well as concerns surrounding regional American banks,” Ripman continues.

Johan Eriksson, co-portfolio manager of Swedbank Robur’s Climate Impact, Global Impact Swedbank and Human funds also focused on the transition. “The main contributing category during the quarter was energy efficiency with strong contributions from the IT optimization/infrastructure and the electric vehicles sub-categories. Besides that, we also saw positive contributions from wind and solar within the alternative energy category,” Eriksson said. “We see that investment incentives in the alternative energy area are starting to become more concrete with the passing of the Inflation Reduction Act in US last year and now we’re starting to see similar initiatives in Europe. We expect this, over time, to be a wind in the back for these funds’ climate-related investments,” Eriksson added.

Marcus Grimfors, portfolio manager of the CB Save the Earth Fund, pointed towards macroeconomic dynamics. “High inflation may have been negative for Growth stocks and, therefore, for the fund, but moderate inflation is probably healthy for the stock markets. We saw Europe as more attractive than USA, which helped fund performance since the fund is overweight European stocks compared to the index, and we believe that will continue,” Grimfors said. Nevertheless, he attributed the fund’s performance to a “strong market, especially European Growth which the fund had a high exposure to. The largest contributions came from individual stocks were Infineon (Germany’s largest semiconductor manufacturer), Nibe (a Swedish company focused on energy-efficient solutions including heat pumps) and Ansys (an American industrial performance software company).”

Per Haldén, portfolio manager of the Navigera Global Change and Global Sustainable Leaders funds, argued that market trends and technical aspects dominated the performance. “During the first quarter, the Navigera Global Change fund still lacked investments in value-based managers. However, as growth stocks became a bit more in favour compared to 2022, performance during the first quarter was roughly in line with the benchmark until the last week of March. By the end of the quarter, we finally got the opportunity to invest in value-based managers,” Haldén explained. “Our robust model and making sure the portfolio does not end up with heavy biases towards certain sectors or regions [were important factors explaining the performance of the Navigera Global Sustainable Leaders fund]. The fund’s performance was in line with the benchmark even though the fund is underweight some of the largest tech names that have driven market performance during the year,” Haldén added.

The Pain from the IT and Consumer Discretionary Sectors

The most recurrent culprits that portfolio managers pointed towards as drivers of underperformance vis-à-vis benchmarks were the IT, communications and consumer discretionary sectors, which some funds seem to underweight to some degree.

Mirella Zetoun, co-portfolio manager of the SEB Global Climate Opportunity and Global Equal Opportunity funds, highlighted the role of the funds’ different investment focus on their performance. “Companies deriving revenues with a positive contribution on climate-related UN Sustainable Development Goals (SDGs) performed well during this period whilst exposure to smaller companies had a negative attribution. The relative overweight in the utilities and real estate sector had a negative contribution whilst the underweight within the financial, health care and energy sector had a positive attribution,” Zetoun said of the SEB Global Climate Opportunity fund. “Our fund selection of companies within the financial, industrial and consumer staples sector attributed positively whilst companies within IT and communication services had a negative contribution. This was due to the strong performance of Apple, Meta, Tesla, Microsoft, Amazon and Alphabet, which the fund has excluded due to norm-based controversies. Companies scoring higher on gender diversity performed well during this period. Companies ranking high in sustainability also performed well during this period,” Zetoun added regarding the SEB Global Equal Opportunity fund.

“The market returns during Q1 were very focused on a few specific large-cap companies within the IT and communication services. For instance, Apple, Alphabet. Meta, Microsoft, Amazon and Tesla contributed roughly 2.46% of the 7.21% return of the MSCI World. Higher interest rates, stubborn inflation together with bank turmoil and the rising cost of capital caused a head-wind for smaller companies, especially those with higher leverage,” Zetoun explained. Meanwhile, the structural trend of the green transition remains strong. “The energy sector underperformed during the first quarter, and the demand for renewable energy is still growing rapidly globally. The re-opening of China has eased supply chain issues and the American IRA (Inflation Reduction Act) has and is still boosting the green climate transition in the US. The Net-Zero Industry Act, Europe’a response to the IRA has had a similar positive effect. The re-opening of China also fed the consumer discretionary sector, and research – both in-house and external) shows that companies with better gender diversity and well-being outperform peers with lower levels,” Zetoun continued. At the same time, there were some green shoots on the social side. The latest report from Equileap points at global progress on gender diversity. There is a rising interest from companies wanting to improve on gender diversity-related topics and government bodies, globally, have made significant legislative commitments to promote gender diversity at work,” Zetoun argued.

Kasper Brix-Andersen, portfolio manager of Danske Invest’s Global Sustainable Future fund, also noted the negative effect of underweighting of mega-cap tech names, as well as consumer discretionary sectors. “Our performance was positively attributed to our overweight in IT sector. However, the mega-cap tech names (like Apple, Nvidia, Meta) outperformed significantly, which made the sector attribution negative overall, and the main explanation. Our strong stock selection in Health Care and also our zero exposure to the Energy sector attributed positively. On the negative side, the Consumer Discretionary sector performed strongly, which is our largest sector underweight. Given our Article 9 focus, we don’t own any energy companies. We generally have an overweight in the IT sector and are underweight Consumer Discretionaries. Both sectors had a negative attribution in Q1 but positive on a one year basis,” Brix-Andersen said. The Danske Invest Global Sustainable Future fund focuses on identifying winners from the energy transition. It was launched following the merger of existing global funds into the global ESG flagship fund on September 8th, 2020. The fund was formally classified as an Article 9 SFDR fund on December 1st 2021.

Huizi Zeng, co-portfolio manager of Espiria’s SDG Solutions fund also argued that underweighting IT and Telecoms as the market shifted to treat Big Tech as a safe haven amid uncertainties hurt the fund’s relative performance. “In general, it has been challenging running an active portfolio with over 40 holdings so far this year. We allocate assets mainly with a bottom-up view over its mid to long-term outlook, but the short-term macro uncertainties remained high and continue to dominate market sentiment. The fund’s first-quarter negative alpha was mainly attributable to a low exposure in the TMT sector (IT, communication services, telecom), weak performance with our renewable holdings, and cyclical names in Industrials and Materials sector,” Zeng argued. However, the fund benefitted from its overweight on the Consumer Discretionary and on the Material sectors. “On the positive side, our Consumer Staple holdings outperformed and the fund’s top positions continue to deliver solid fundamentals. Small cap stocks experienced weakness and volatility except for Feb risk-on month,” Zeng explained. The fund, which was launched (as an Article 9 fund) on October 1st 2021 and is a part of the East Capital Group, benefitted from its limited exposure to the turbulence in the banking sector. “The fund has only one banking stock, so it outperformed the benchmark on the financial sector. The fund’s Health & Empowerment theme has strong association with pharma companies that often are defensive in nature. However, this year it was Big Tech that became the safe haven amid uncertainties,” Zeng continued.

The Blue Funds

Among the new entrants to NordSIP’s survey, two global funds focus on the blue economy: the DNB’s DNB Future Waves fund and the FCG Havsfond (sea fund).

Based on a pre-existing fund, the DNB Future Waves was launched in June 2021 with a focus on 11 of the UNs Sustainability Development Goals with investing themes in the Blue Economy (42.6% of assets under management), the Green Economy (32.7% of AuM), Climate (11.9% of AuM), and Quality of Life (9.2% of AuM) [1]. The fund was classified as Article 9 SFRD at the beginning of Q1 2023. Discussing the performance of the DNB Future Waves fund, portfolio managers Audun Wickstrand Iversen and Isabelle Juillard Thompsen, emphasised the role of energy efficiency, automation, wastewater sanitation, water purification, underwater energy transmission cables and energy storage.

“The Green Economy theme had a strong relative performance, contributing 3.8%, primarily driven by our energy efficiency tech and automation enablers. The Blue Economy had a good contribution of 2%, with continuing good performance, particularly companies focused on water treatment and recycling. The fund’s four largest holdings per Q1 are within the Blue Economy theme, focusing on wastewater sanitation, water purification technologies and submarine energy transmission cables. The Climate theme had a slight positive contribution with companies in the solar energy space being both the key contributor and detractors within the theme. The Quality of Life theme showed limited negative performance. The positive contribution came from a rebound of the future of food holding in addition to mixed results from our healthcare holdings. We continue to see strong structural trends for long term growth in ESG and within our investment themes. We witness an increasing focus on identifying water-related risks across all industries, now an increasing consideration in investment decisions. As for the Green Economy and Climate themes we continue to see the IRA as most transformational for battery storage, hydrogen, carbon capture and energy efficiency while supportive for renewables, the EV chain, nuclear and low-carbon fuels,” Iversen and Thompsen wrote in the funds quarterly report.

Lise Børresen, Head of Responsible Investments at DNB Asset Management noted continued “strong structural trends for long term growth in ESG and within our investment themes and witness an increasing focus on identifying water-related risks across all industries. This is an increasing consideration in investment decisions, as addressed in the UN 2023 Water Conference held at the UN headquarters in New York in late March.” Asides from the USA’s Inflation Reduction Act (IRA) and the EU’s Green Deal, Børresen also noted “the ‘Powering up Britain’ policy papers were published in late March, conveying the UK governments strategy to achieve energy security and independence,” a “policy measures could trigger GBP 100bn of private investments.”

Launched at the end of November 2022, Havsfonden is a global equity fund investing in the blue economy across developed markets (44% of AuM in USA; 20% in Europe and 14% in Japan). Beyond its investments, the fund also provides financial support to research and work for a healthier Baltic Sea through the donation of funds to selected Baltic foundations and non-profit organizations. “The fund’s performance in Q1 2023 was positively influenced by the development of the industrials and materials sectors. Notably, the industrials sector demonstrated strong performance during this period, with standout contributors including the marine transport and waste management segments,” Robert Lindblom, portfolio manager of the FCG Havsfond said. “As a thematic fund focusing on the blue economy there is a significant exposure to the Industrials sector, followed by the Utilities sector and the Materials sector. The Industrials sector demonstrated a growth of 6.6%, Utilities sector experienced a modest growth of 0.2% and the Materials sector exhibited a growth rate of 5.7% in the first quarter, as measured by the total return in SEK. Other sectors that are naturally absent from the blue economy, such as IT and Communication Services, have experienced an exceptionally positive period,” Lindblom added. [2] “In the wake of the banking collapses, the global markets have undergone a tumultuous quarter marked by significant volatility. There was a notable disparity in the returns of different sectors, with growth-oriented sectors exhibiting strong performance and outperforming both the value-oriented sectors and the traditionally defensive sectors, which both have substantial representation within Havsfonden,” Lindblom continued.

Nordic- and European-Focused Funds

Investors looking for Article 9 funds with a narrower geographical focus can also look to the SEB Nordic Future Opportunities fund managed by Robert Vicsai, the Fondita Sustainable Europe fund managed by Marcus Björkstén or the Norron Sustainable Equity fund managed by Johan Svantesson. [3]

The Norron Sustainable Equity is an actively managed long-only equity fund launched in at the end of September 2020 and classified as Article 9 in September 2021, focused on large-, mid- and small-cap companies in the Nordics (about two-thirds are invested in Mid and Small Cap). Norron’s Svantesson noted that most of the positive contributors to the fund enjoyed a strong performance in the fourth quarter of 2022. Meanwhile, the stocks that contribute negatively to the portfolio seemed to have been “driven by flows rather than company-specific news,” according to the portfolio manager. “In addition, we did have a few companies that reported a somewhat weak Q4 or where the guidance was somewhat weak. Companies that showed strong earnings reports did not benefit to the same extent as it negatively affected companies that delivered weak earnings reports. Also, in general, large-cap performed better than small-cap, which affected the performance [of the fund] negatively. On the positive side, we see interesting opportunities in the small-cap space in the mid to long term,” Svantesson added.

“[This was a] very mixed and difficult quarter, given the fund’s particular thematic focus. It was rather mixed. No particular segment within the climate- and environmentally smart solutions over- or under-performed. We saw some share prices overreact, on the downside in particular, which illustrated the somewhat nervous investor sentiment during Q1,” Fondita’s Björkstén explained. “Because of the fund’s sharp thematic focus, it has no exposure to Health Care/Pharma , Financials, Consumer Goods, IT, Real Estate or Oil & Gas. The top contributors to the fund’s performance were Kempower, Nibe and Infineon,” Björkstén concluded.

Footnotes:

[1] Figures for AuM shares of the DNB Future Waves Fund are for the end of May 2023. [2] With regards to the benchmark of the FCG Havsfond, Robert Lindblom noted that “the fund’s benchmark index is MSCI World Net Total Return Index USD (converted to SEK). The benchmark index is used only for comparative purposes, e.g. for the calculation of active risk and when presenting the fund’s past performance. The fund is not intended to track the index. The index does not consider ocean benefits and ESG factors and does not correlate with the fund’s sustainable goals.” [3] The managers of all three of the non-global funds expressed concerns about the use of a benchmark for the analysis of their performance. Vicsai noted that the benchmark was an inherited index that would hopefully be changed in the future given that the SEB Nordic Opportunities Fund does not overlap with a substantial share of the NASDAQ VINX Benchmark Cap NO SEK index it officially tracks. Fondita’s Björkstén and Norron’s Svantesson noted that their funds did not have an official benchmark. Björkstén pointed to the MSCI Europe Climate Paris Aligned Index as an unofficial benchmark. Although Morningstar uses the MSCI Nordic Countries index as an unofficial benchmark for Norron’s Sustainable Equity fund, Svantesson noted that Norron was in the dialogue with Morningstar to change the benchmark to one that reflect the fact that about two thirds of the fund’s portfolio in Small and Mid Cap companies. Instead, on the suggestion of Svantesson, this analysis used the Carnegie Small CSX Return Nordic as a benchmark for this fund.