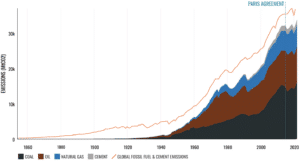

The latest update to the Carbon Majors database does not paint a pretty picture. However, it is a thorough piece of research that helps to shine a bright light on the small number of companies that seem intent on driving all of us off the climate crisis cliff. The database tracks the cumulative emissions of 122 industrial companies from 1854 right through to 2022. The first iteration was released by Richard Heede of the Climate Accountability Institute (CAI) in 2013, with the latest update now hosted by climate NGO InfluenceMap with all the data freely available to the public.

The overall increase over the entire period is no surprise. What is shocking is the growth in emissions from oil, gas, cement, and even coal since the signing of the Paris climate agreement at the end of 2015. Although investor-owned companies have somewhat reduced their combined emissions over that recent period, state-owned and nation state companies have sharply increased theirs. Across the three groups, just 57 corporate and state producing entities have been responsible for 80% of the global emissions since the Paris agreement. Perhaps time to narrow the focus to a Climate Action 60?

Carbon Majors & Global CO2 Emissions (1854–2022)

Source: carbonmajors.org

The three biggest culprits in the private sector are Chevron, ExxonMobil, and BP over the entire period covered by the study. The state-owned bad guys are unsurprisingly Saudi Aramco, Gazprom, and the National Iranian Oil Company. China, with its voracious appetite for coal and the former Soviet Union have the biggest share of nation state producers’ historical emissions. It seems that while private companies shifted away from coal the nation states took up the slack and burned yet more coal.

Readers of this column (or any sustainability professionals) will not be particularly surprised by all of this, so what is the point of this database? The quality and granularity of the data, the length of the timescale and the high level of transparency mean that the Carbon Majors has been a powerful tool for holding the worst emitters to account. It has also been used as evidence in litigation against companies accused of climate-related human rights violations. The ability to name and shame is a useful tool in this climate crisis. Obviously, some of the nation state entities are more than happy to shrug off the criticism, but the slight decline in the private sector might have been partly due to external pressure.

The database offers dataset downloads of varying degrees of granularity, including entity type, commodity, commodity production, commodity unit, total emissions, data point source, product emissions, and the four different operational emissions: flaring, venting, own fuel use, and fugitive methane.

The stagnation or growth in emissions from these entities since the signing of the Paris agreement is yet more evidence that international climate negotiations are neither progressing fast enough nor being taken seriously by these 57 carbon-bomb villains. Carroll Muffet, President and CEO of the Center for International Environmental Law (CIEL) puts it this way: “The Carbon Majors database makes it dramatically easier to document, calculate, and visually demonstrate the growing chasm between the urgent demands of climate reality and the continued reckless and intentional growth of oil and gas production.” The investment community and financial industry would do well to use this tool to clamp down hard on these companies. Thanks to the hard work of these non-profits, they will find it harder and harder to fool all of the people all of the time.