Stockholm (NordSIP) – As fixed-income markets closed the first half of the year, sustainable bond issuance seemed to remain on track with that of previous years. However, despite the growth, sustainable issuance represented a smaller fraction of the market due to faster growth in traditional fixed-income markets.

In the Nordics, Sweden caught up with its neighbours to once again establish itself in a position of dominance. Globally, fears that taxonomy alignment is still occurring too slowly and that the politicisation of sustainability and ESG in the USA may undermine the efforts of responsible investors were the dominant trends.

Sustainable Bonds Slow Down

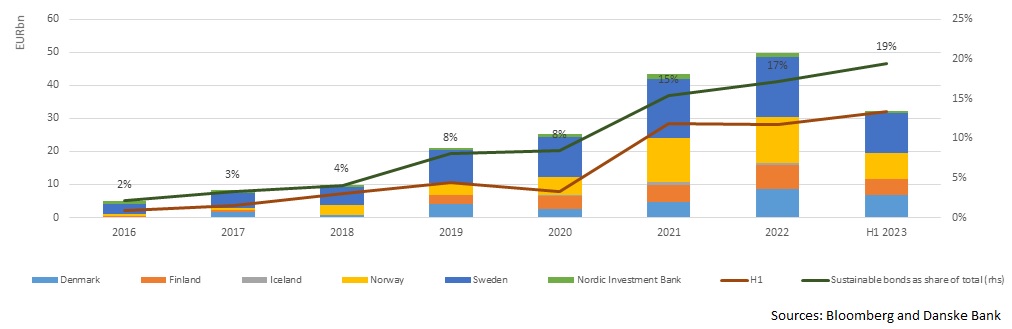

Global sustainable issuance in the second quarter of 2023 reached €258 billion, down from the €253 billion witnessed in the same quarter of 2022, according to data from Bloomberg and Danske Bank. Although global sustainable bond issuance is in line with that for the first half of the year for the last two years, sustainable bonds represent a smaller share of the total (green line below) because total bond issuance has increased faster in the same period. Whether this is a function of the growing fears of investors vis-à-vis ESG products given conservative political pushback in the USA or a coincidence remains to be seen.

From a structure perspective, during the first half of 2023, green bond issuance continued to dominate, followed by sustainability and social bonds, with sustainability-linked bonds (SLBs). On a sectoral basis, financial institutions led the way, representing approximately 27% of all sustainable issuance during the second quarter of the year, followed by corporates (24%), sovereigns (17%) and asset-backed securities (6%). The dominance of financial institutions is unusual. For the same period in 2022 and 2021, this sector only represented 19% and 17%, respectively. Corporates tend to dominate with about a quarter or a third of the issuance.

Sweden Back on Track

Looking at the Sustainable Bond market in the Nordics suggests we are on track for another record year. Nordic sustainable issuance in the second quarter of 2023 reached €15.3 billion, down from the €16.9 billion witnessed in the first quarter of the year.

Another salient fact from the second quarter of the year was the increase in issuance from Sweden, which had fallen behind Denmark in the first quarter. According to figures compiled by Danske Bank and Bloomberg, during the second quarter of the year, issuance in Sweden represented 53% of the total for the Nordic region, followed by Norway (21%), Finland (15%) and Denmark (10%). All in all, during the first half of the year, Sweden represented 38% of the issuance originated in Sweden, followed by Norway (24%), Denmark (23%) and Finland (15%), according to data from Bloomberg and Nordea.

According to data from Danske Bank and Bloomberg, Sustainable Bond issuance in Swedish Krona was up three-fold in relation to the same period last year, while issuance in EUR was flat.

Financial Institutions Continue to Lead the Way

Sectorally, financial institutions were even more dominant during the second quarter of the year in the Nordics, representing over 50% of issuance, followed by corporates (38%), supranational and government agencies (7%) and sub-sovereigns (4%). Since 2020, financial institutions have been steadily gaining market share, mostly at the detriment of sovereigns, supranationals and agencies.

At the end of March, Handelbanken Stadshypotek came to the market through its real estate subsidiary with an inaugural 5-year green covered bond worth €1 billion. In the beginning of April, NP3 Fastigheter, a Swedish real estate company, issued a 3-year SEK500 million high yield green bond that pays 550 basis points (bps) over the 3-month STIBOR. At the end of April, Council of Europe Development Bank issued a SEK650 million five-year Social Inclusion Bond (SIB), the largest social bond in the Swedish market at this stage and the first such social bond from an SSA issuer.

In May, Danfoss, a provider of energy efficiency, sustainable electrical and mechanical solutions issued its inaugural €500 million 6.5-year SLB. Still in May, the Region of Stockholm came to the market with a SEK 950m 4-year Green Bond. At the end of the same month, Stora Enso issued €1 billion in two equally-sized tranches with 3- and 6.25-year maturities that pay a fixed coupon of 4% and 4.25%, respectively. In June, Stadshypotek returned to the market with another inaugural Green 5y Covered Bond, this time a SEK9 billion in dual-tranche format.

Outside of the Nordics, but staying with Swedish Krona, the European Investment Bank (EIB) came to the market with its inaugural digital Climate Awareness Bond, worth SEK1 billion with a maturity of 2 years. The bond pays a 3.638% fixed rate coupon and was joint lead managed by Crédit Agricole CIB and SEB.

Danske Bank bank is the most prominent Nordic dealer, the sixth largest (in volume) for all of Europe and the tenth globally. Focusing exclusively on Nordic Corporate Sustainable Bonds in 2023 H1, Nordea leads the way, followed by SEB and Danske Bank.

Challenges, Credibility and (USA) Politics

Asides from observations about market trends, one of the most recurrent commentaries focused on the increasingly politicised and polarised discourse around ESG and sustainable investing, particularly in the USA.

“While the green bonds and sustainability bonds are performing at record levels, we see social bond at a normal pace and Sustainability-Linked Bond issuance dropping behind,” Lars Mac Key, Head of DCM Sustainable Bonds at Danske Bank. “Financials are at record levels, while corporates are falling behind. Traditional strong issuers, such as Enel who issued the equivalent of US$11.5 billion in SLBs in 2022, have not been very active in 2023. In the US, it seems the politicized ESG situation has an effect on the Sustainable Bond market too, where especially corporates and financials are issuing less in USD,” Mac Key continues.

“Globally, we see that credibility will be the greatest challenge moving forward for sustainable debt markets,” said David Ray, ESG Specialist at Nordea Sustainable Finance Advisory. “As markets continue to expand, and a greater variety of issuers and structures emerge, the sustainable debt formats will face increasing challenges to credibility. This scepticism may have begun to impact sustainable finance markets already as sustainability-linked bonds, perhaps the most closely-scrutinised format, dropped in market share for the first time (down to 7% in H1 2023 from 9% in 2022),” Ray continued.

“While we must welcome the interrogation of labelled debt products to ensure robustness from a sustainability perspective, the market must find a balance between scepticism and the ability to provide appropriate incentives for issuers across the whole economy to improve sustainability performance. We see sustainability-linked green bonds as well-placed to provide both incentive to issuers and confidence to investors,” Ray added.

Taxonomy Alignment in Europe

On our side of the pond, the focus remained on the EU Taxonomy and the low alignment. “In the Nordics, we see the alignment of green bond frameworks with the EU taxonomy as a short-term challenge. Our research shows that the average EU Taxonomy alignment of capex in the Nordic company universe was 8% by market cap. These low alignment figures highlight that there is still a gap that must be bridged in order to ensure that sustainable financing is able to meaningfully contribute towards the EU’s sustainable finance ambitions, Ray argues.

“The, understandably, somewhat conservative interpretation of the EU taxonomy that we currently see is likely to continue for the next few years. Until there is more comfort around the reporting of EU Taxonomy eligibility and alignment, we foresee a recurring challenge in aligning green bond frameworks with the EU Taxonomy,” Ray concludes.